How to Implement the Families First Coronavirus Response Act

by Shawn Harju | March 23, 2020The President signed the “Families First Coronavirus Response Act” (“FFCRA”) on March 18th, 2020, which will take effect on April 2nd, 2020, and ends on December 31st, 2020. Now, businesses are stuck wondering how to implement the requirements and in such a short period of time. The Department of Labor and the IRS are working to provide more details around the law that will give clarity to all businesses. While your questions remain unanswered until these details are fleshed out, we have some pertinent information to help you take steps to implement the new laws.

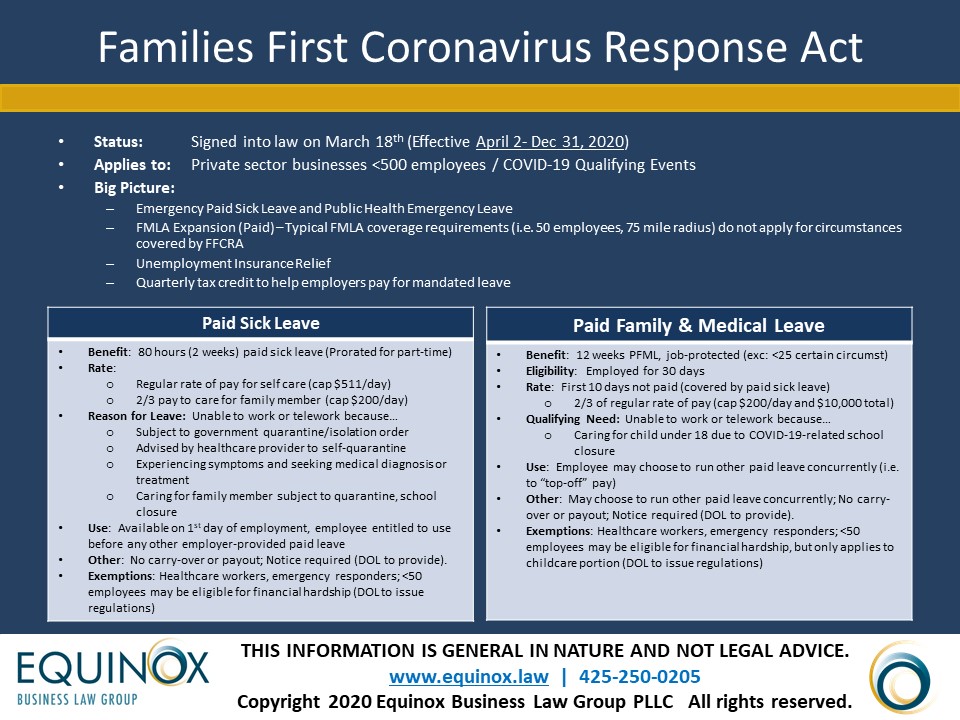

What does the Families First Coronavirus Response Act Require? If your company has less than 500 employees, the law provides for paid leave in certain circumstances and specified amounts.

What About Current Leave Benefits & Laws?

The FFCRA benefits are in addition to leave benefits already provided by you to your employees. Also included are current leave laws such as Paid Sick and Safe Leave and Washington paid Family & Medical Leave.

Paid Sick Leave. For an employee to qualify for Paid Sick Leave, the employee must not be able to work or telework due to:

- a government order/isolation order;

- advisement from their healthcare provider to self-quarantine;

- symptoms for which they are seeking medical diagnosis/treatment, or;

- caring for a family member subject to quarantine or school closure.

The amount received by an employee for self-care has a cap of $511/day and $5,110 total (10 days). An employee providing care for a family member may receive $200/day and $2,000 total (10 days). A part-time employee’s leave will be the average hours worked for over two weeks.

Paid Family & Medical Leave. For an employee to qualify for PFML, under the new law, and job protection up to 12 weeks, an employee must be unable to work or telework due to caring for a child because of a school closure. Paid sick leave will cover the first 10 days. Leave beyond the first 10 days will be paid at 2/3 of the employee’s regular rate of pay and $12,000 in total.

Unused leave. Unused leave will not carry over to 2021. You are not required to pay out the unused leave upon an employee’s separation from employment.

Unemployment. An employee cannot receive unemployment benefits and Paid Sick Leave simultaneously.

Providing Notice: Employer & Employee

Notice to Employees. You will be responsible for notifying employees of these new leave benefits. We expect The DOL will provide the required notice this week. This notice should be posted with other mandatory posters.

Notice to Employer. Where possible, an employee should give advance notice of their need to take leave. After the first workday of Paid Sick Time, employers may require employees to follow reasonable notice procedures to continue to receive Paid Sick Time.

How Do I Cover The Costs of the Families First Coronavirus Response Act?

Tax relief is available. Businesses that are required to provide emergency paid sick leave and emergency paid family, and medical leave under the Act will be eligible for tax credits.• For an employee unable to work because of Coronavirus quarantine, self-quarantine, or Coronavirus symptoms, your business may receive a refundable credit for the leave at the employee’s regular rate of pay.

- For an employee caring for someone with Coronavirus or caring for a child because of a school closure or unavailability of childcare, your business may claim a credit of two-thirds of the employee’s rate of pay.

- An additional tax credit may be provided to your business based on the costs to maintain health insurance coverage for the employee during the leave period.

- The tax credits available to you will equal the amounts (including the caps) to which the law entitles the employee.

- The filing and payment deadline for income taxes for individuals and businesses received an extension to July 15th, 2020. There is no need to filing a request for an extension unless you require one beyond the deadline.

How do I get tax relief? Your business may retain amounts they would typically pay the IRS. In the event the amount withheld does not cover their costs, you may receive and to receive additional refunds.

- Instead of paying the IRS the amounts of the typical employee withholding (federal income taxes, social security, Medicare taxes), you will be able to retain a portion of the withheld taxes equal to the amount of paid leave.

- If the payroll taxes are not enough to cover the leave paid, an employer will be able to file a request for an accelerated payment from the IRS. The IRS anticipates a two week process time. Expect further details for this process to be released by the IRS this week.

- Similar tax credits are available to self-employed individuals to reduce their estimated tax payments.

How Do I Comply in Such a Short Period?

Enforcement. The law is effective April 2nd, 2020. While that is not that far away, the Department of Labor is providing a 30-day grace period beyond April 2nd to allow you time to come into compliance with the law. The DOL will not seek to enforce the law as long as you are acting reasonably and in good faith. Their primary focus will be assisting employers with compliance.

Consider whether your business is exempt. The law allows certain exemptions for small businesses. Employers with fewer than 50 employees will be eligible for an exemption from the leave requirements if the law will jeopardize the business’s ability to continue. Employers with fewer than 25 employees may be exempt from the job protection requirements under the Paid Medical and Family Leave portion. The DOL will provide criteria and further guidance on this exemption.

As April 2nd draws near, the DOL and the IRS will provide additional regulations to help you implement these provisions.

Enlist Help

We are happy to provide a complimentary consultation to help you understand how these new leave provisions impact your business. Contact Michelle Bomberger at 425-250-0205 or contact@equinoxbusinesslaw.com.

Legal Disclaimer: This article contains general information and should not be viewed as legal advice. You should talk with counsel familiar with your unique business needs before taking or refraining from any action.